Introduction

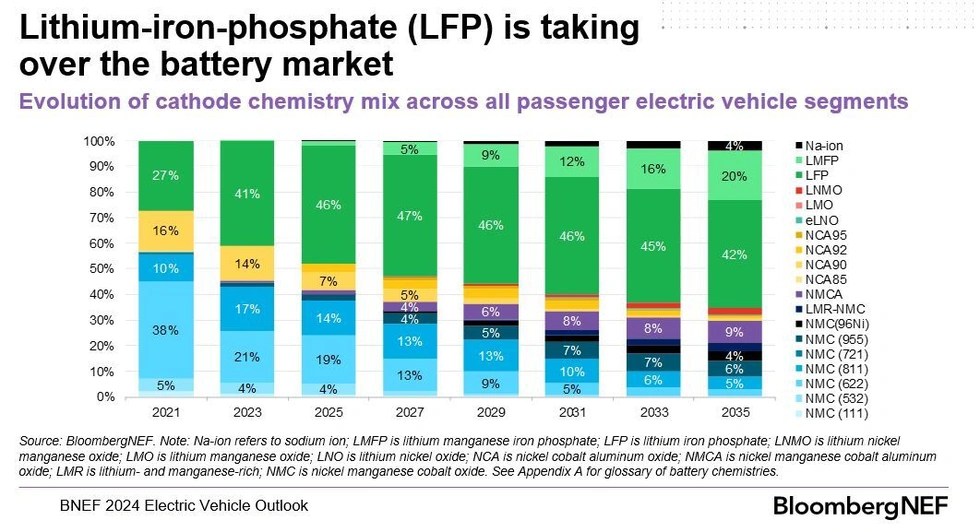

Though lithium iron phosphate (LFP) batteries technology has existed for decades, it was historically overshadowed by nickel manganese cobalt (NMC) batteries, primarily due to its lower energy density. However, the tide has turned. LFP batteries now dominate entry-level electric vehicle (EV) models and energy storage systems, owing to their cost-effectiveness, extended cycle life, and enhanced safety. Analysts predict that by 2026 or 2028, the adoption of LFP batteries will surpass NMC in the EV market.

The next frontier in battery chemistry, Lithium Ferro Manganese Phosphate (LFMP), promises to address LFP’s limitations. By incorporating manganese into the LFP structure, LFMP batteries achieve higher energy densities while retaining the cost and safety advantages of their predecessors. In this article, we explore the technical developments, market implications, and future potential of LFMP technology.

The Fundamentals of LFP Batteries

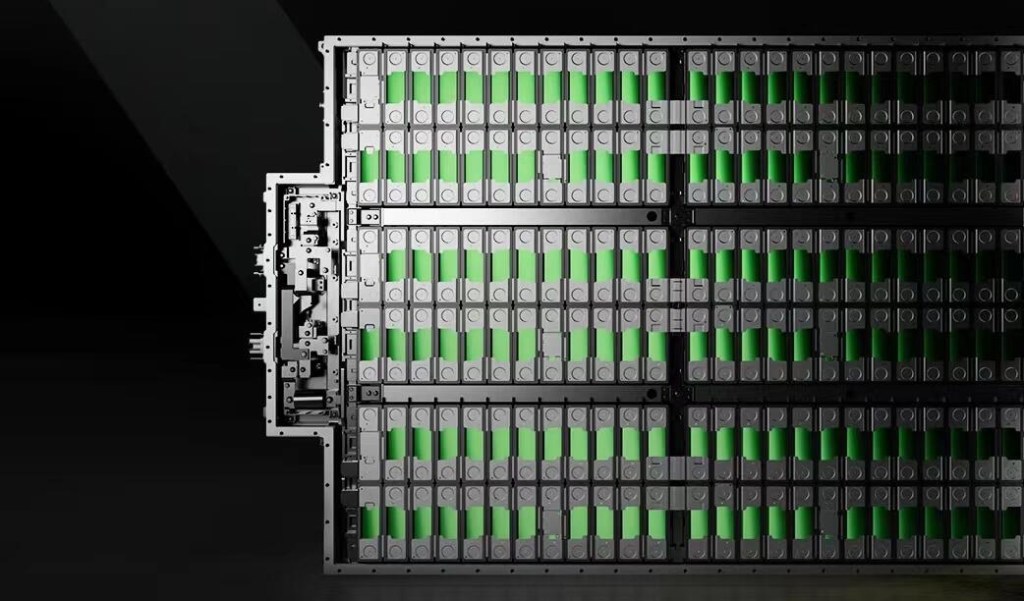

LFP batteries use a cathode composed of lithium, iron, and phosphate, paired with a graphite anode. While the energy density of LFP cells (approximately 170 Wh/kg) lags behind NMC cells (280–300 Wh/kg), several advantages make them a compelling choice:

- Cost Efficiency: LFP batteries eliminate the need for critical raw materials like cobalt and nickel, which are expensive and subject to supply chain volatility.

- Longevity: With a lifespan of 3,000–8,000 cycles, LFP batteries far outperform NMC cells, which average 1,000–2,000 cycles.

- Safety: The olivine crystal structure of LFP ensures thermal and chemical stability, reducing risks of overheating or combustion.

These benefits, coupled with declining production costs, have accelerated LFP adoption in energy storage and entry-level EVs, particularly in China, where over 60% of EVs already feature LFP batteries.

The Emergence of LFMP Batteries

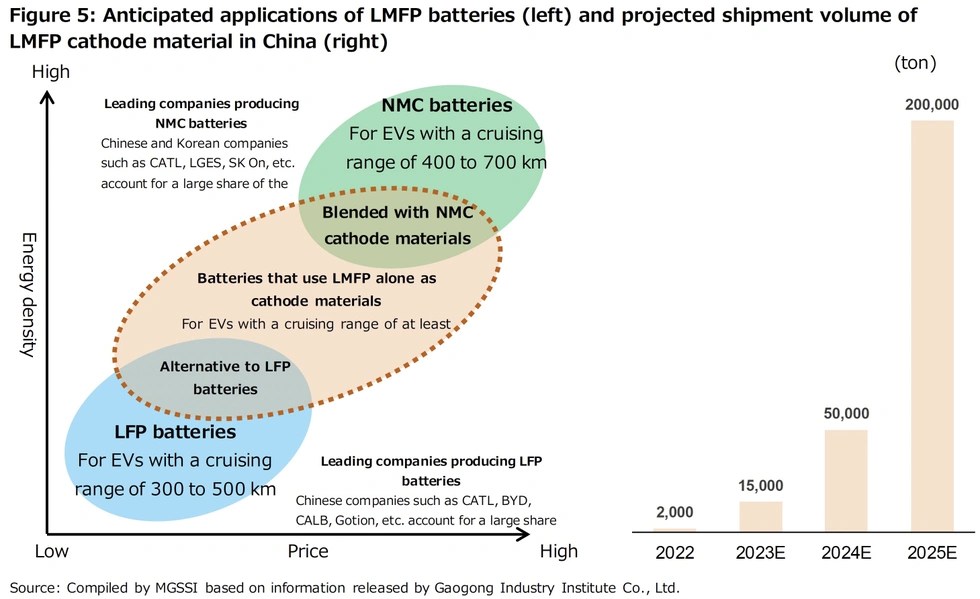

Lithium Ferro Manganese Phosphate (LFMP) represents the next evolutionary step in phosphate-based battery technology. By adding manganese to the LFP chemistry, LFMP achieves a higher energy density (210–240 Wh/kg) while maintaining the cost and safety benefits of LFP. This improvement is due to manganese’s ability to enhance the crystal structure’s stability and facilitate lithium-ion diffusion.

Key Improvements

- Increased Energy Density: LFMP batteries operate at a higher voltage (3.7V) compared to LFP (3.2V), bridging the gap with NMC cells. This voltage boost, coupled with improved ionic conductivity, results in greater energy storage capacity.

- Enhanced Charge Rates: Manganese improves electronic conductivity, enabling faster charging without compromising thermal stability. This advancement addresses a historical limitation of LFP cells, which have lower fast-charging capabilities than NMC.

- Longer Lifespan: Preliminary studies suggest LFMP batteries retain capacity over thousands of charge-discharge cycles, outperforming NMC cells in durability while slightly trailing LFP.

- Sustainability: LFMP batteries rely on manganese, an abundant and inexpensive material, further reducing reliance on scarce resources.

Technical Overview

The table highlights LFMP’s balanced performance profile, combining LFP’s safety and longevity with NMC’s energy density.

Commercialization and Early Adoption

LFMP production began in 2023, with leading manufacturers like CATL, Gotion, and BYD driving adoption. CATL’s M3P cells, an advanced iteration of LFP, are rumored to incorporate manganese, achieving higher energy densities and improved charging performance. These cells have already been integrated into select EVs in China, including Tesla’s locally produced Model 3 and Y.

Notable Developments:

- Gotion’s L600 Astroinno Cells:

Announced in mid-2023, these LFMP cells boast an energy density of 240 Wh/kg and a volumetric density of 525 Wh/L. Promising a lifespan of up to 1.9 million kilometers under specific charging conditions, they are positioned as a game-changer for EV longevity.

- CATL’s Roadmap:

CATL plans to scale LFMP production by 2025, with energy densities expected to surpass 230 Wh/kg. The cells are designed for mid-range EVs and entry-level long-range models.

- Luxeed S7 Sedan:

Developed by Chery in collaboration with Huawei, this EV features CATL’s LFMP cells, delivering a range of up to 855 kilometers (CLTC standard).

Future Potential of LFMP

Analysts predict that LFMP batteries will dominate the mid-range EV market by 2030, offering a compelling balance between cost, safety, and performance. Key drivers include:

- Scalability: LFMP leverages existing LFP manufacturing processes, enabling a seamless transition for producers.

- Cost Advantage: LFMP cells are 5% cheaper than LFP and 20–25% cheaper than NMC, making them attractive for cost-sensitive markets.

- Sustainability: With reduced dependency on critical materials, LFMP aligns with global efforts to decarbonize supply chains and localize production.

Challenges and Limitations

While promising, LFMP faces hurdles:

- Limited Lifespan Data:

As a relatively new chemistry, LFMP’s real-world durability is not fully validated.

- Energy Density Gap:

Despite improvements, LFMP remains less dense than high-nickel NMC cells, limiting its use in weight-sensitive applications like aviation.

- Geographic Concentration:

LFMP development is currently dominated by Chinese manufacturers, potentially leading to regional supply chain dependencies.

Conclusion

LFMP batteries mark a significant milestone in battery evolution, addressing the energy density limitations of LFP while preserving its cost and safety advantages. As the global EV market expands, LFMP’s balance of affordability, performance, and sustainability positions it as a transformative technology.

While NMC cells will likely remain dominant in premium applications, LFMP is set to redefine mid-range EVs and energy storage solutions. With mass production ramping up and adoption accelerating, the next decade could see LFMP as a cornerstone of sustainable electrification.

Leave a comment